GEOSPATIAL INTELLIGENCE

FOR THE GLOBAL COFFEE SUPPLY CHAIN

Market Forecasting • Satellite Analytics

FOR THE GLOBAL COFFEE SUPPLY CHAIN

Market Forecasting • Satellite Analytics

Actionable intelligence combining climate signals, satellite analytics, and predictive modelling for the global coffee sector.

Arabica-first intelligence system with full flexibility to expand across Robusta and emerging producing regions.

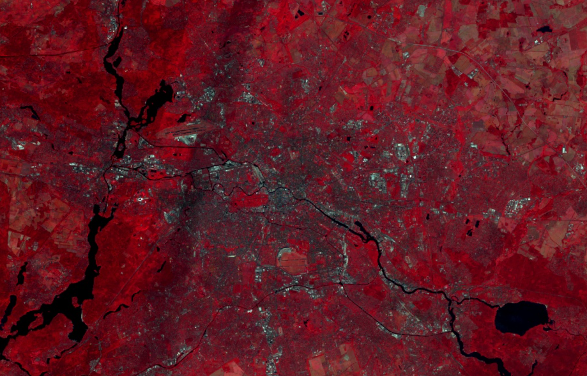

Monitoring across 40+ coffee-producing countries, blending remote sensing, climate models, and on-ground validation.

Predictive analytics delivering up to 6-month forecasts of climate risk, yield instability, and futures-price volatility.

Global coffee production is increasingly exposed to climate volatility, supply-chain disruption, and environmental uncertainty. Our geospatial intelligence platform transforms these signals into predictive market insight.

Detect environmental stress trends before crop losses materialize.

Anticipate price volatility driven by climate anomalies.

Quantify long-term risks affecting yield, quality, and trade flows.

From raw satellite signals to predictive coffee-market insight — each stage flows through a purpose-built, AI-enhanced pipeline.

Multi-sensor satellite feeds, climate archives, in-situ weather measurements, and supply-chain signals.

Calibration, cloud-masking, harmonisation, statistical filtering, and anomaly extraction.

Deep-learning models integrate climate, vegetation, thermal, and market signals to generate predictive intelligence.

Market-ready indicators, dashboards, APIs, and decision-focused intelligence outputs.

Climate risk is now a defining force across global coffee markets. From producers to traders to financial institutions, every stakeholder requires forward-looking intelligence to protect margins, secure supply, and anticipate market impacts.

Identify upcoming climatic stress, optimise crop management, and reduce yield uncertainty with predictive growing-season insights.

Forecast production shortfalls and regional quality shifts to secure supply, plan procurement, and mitigate logistics risk.

Gain early signals of price-moving climate anomalies, strengthening directional strategies and volatility forecasting.

Protect sourcing portfolios, anticipate cost pressures, and strengthen long-term origin planning with climate-driven insight.

Integrate geospatial climate risk metrics into pricing models, portfolio strategies, and commodity exposure management.

Monitor long-term climate vulnerability, verify environmental compliance, and track resilience indicators across producing regions.